Modular extensions

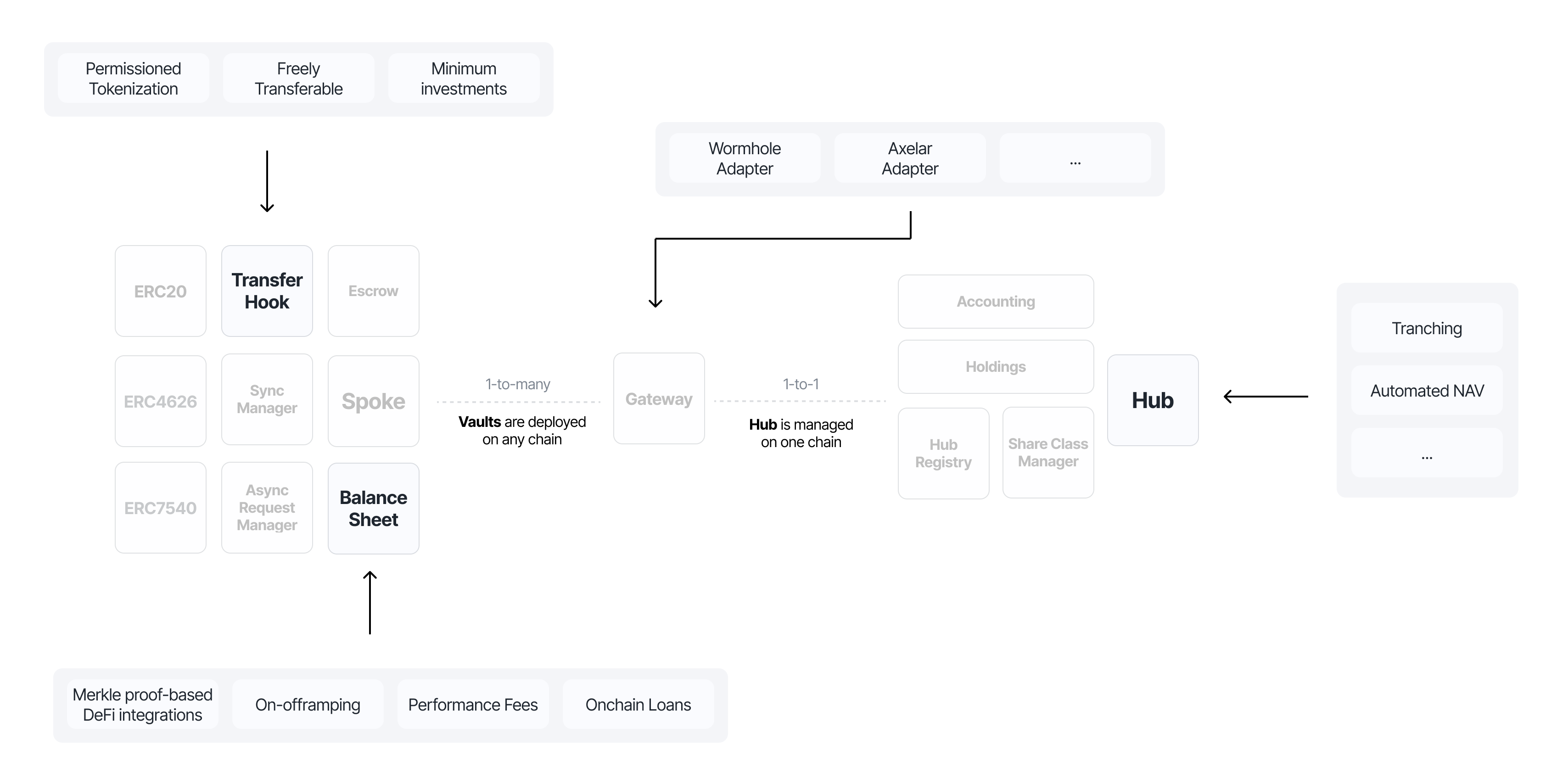

The Centrifuge Protocol is designed as a modular, extensible system to support complex financial products. This architecture empowers builders to plug into various components independently or collectively, enabling permissioned tokenization, cross-chain deployment, custom pricing logic, and diverse collateral management.

Below is an overview of the smart contracts of the Centrifuge Protocol and where builders can plug in, with some examples:

Transfer Hooks

Transfer Hooks are customizable restrictions and checks that can be applied to ERC20 tokens. They serve as plug-and-play extensions for enforcing:

- Permissioned tokenization: Ensure compliance and access control.

- Freely transferable tokenization: Used for deRWA tokens to integrate into DeFi.

- Minimum investment thresholds: Limit the minimum investment amount.

These hooks integrate directly with ERC20 token logic and enable regulatory and operational controls without changing the core token.

Hook Managers

Hook Managers are smart contracts deployed on Spoke chains that build on top of the Transfer Hooks system to provide automated account management capabilities. These managers interact with the underlying transfer restriction hooks to enable:

- Automated whitelisting: Programmatically add or remove addresses from whitelists based on custom logic or external events

- Freezing and unfreezing accounts: Dynamically control which accounts can transfer tokens in response to compliance requirements or risk events

- Custom access control logic: Implement sophisticated rules for managing who can hold and transfer share tokens

Hook Managers enable builders to create permissioning systems that respond to onchain or offchain events, integrate with KYC/AML providers, or implement time-based restrictions - all without requiring manual intervention or modifications to the core token contracts. This provides a flexible layer for managing compliance and access control at scale.

Hub Managers

The Hub is the central smart contract responsible for managing Net Asset Value (NAV) calculations, investor share class logic, and fund-level mechanics. Using Hub Managers, developers can define custom logic for:

- Automated NAV and token pricing

- Waterfall structures and tranching

- Custom share class management

- Request fulfillment logic

This module provides fine-grained control over fund architecture and investor dynamics, enabling fully customizable on-chain fund operations.

Balance Sheet Managers

Balance Sheet Managers enable the protocol to support and manage any form of collateral. Whether dealing with tokenized real-world assets (RWAs), stablecoins, crypto-native tokens, or other DeFi protocols - Balance Sheet Managers abstract the logic required to:

- On/off ramping for assets

- Integrating DeFi protocols

- Tracking performance and management fees

- Integrating onchain loans

This makes Centrifuge ideal for bridging traditional finance and DeFi through modular asset management.

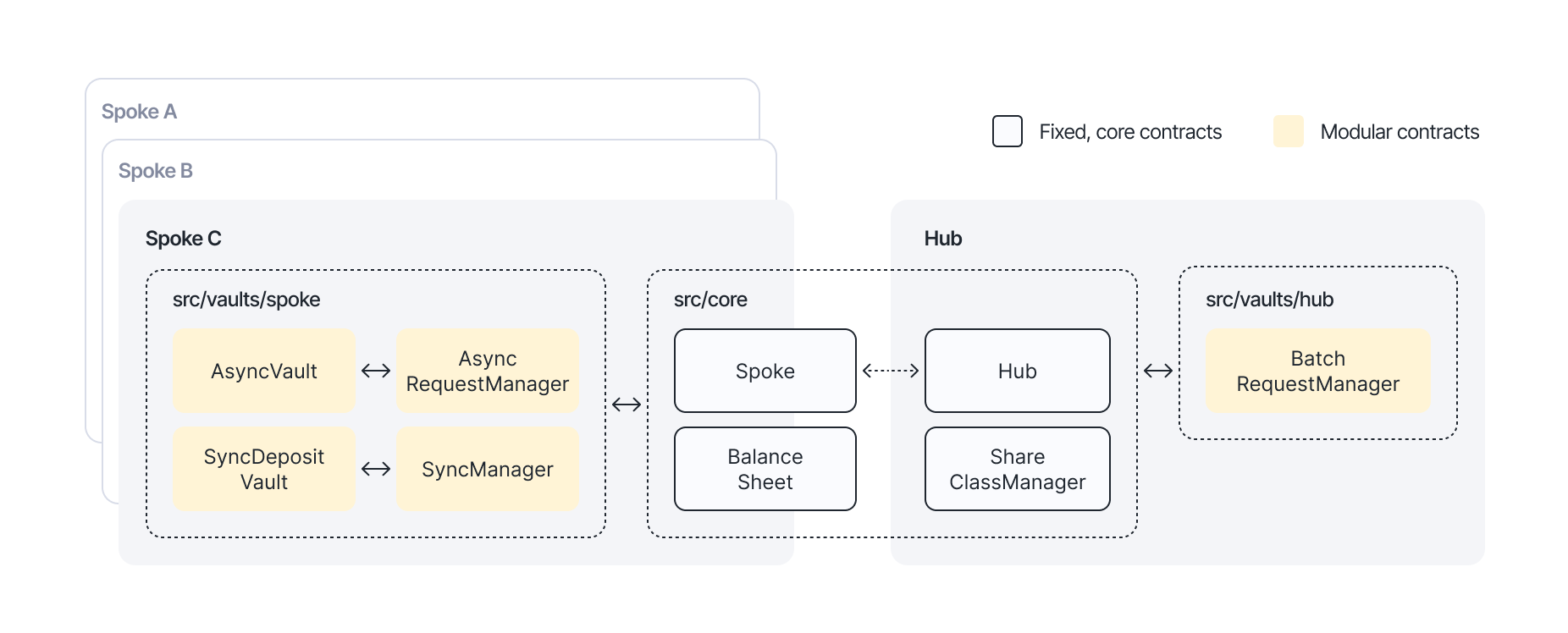

Request Managers

Request Managers can be implemented to enable custom investment and redemption logic cross-chain.

The image below shows the primary vaults implementation in the protocol, and how it leverages the immutable core as the base for the cross-chain request handling logic. The orange contracts can be fully customized.

Adapters

Adapters are the interoperability layer of the protocol. They connect pools on Centrifuge to any blockchain, enabling cross-chain vault deployment and communication. Supported adapters include:

- Wormhole adapter

- Axelar adapter

- LayerZero adapter

Adapters route cross-chain messages via the Gateway contract, maintaining a 1-to-many relationship between a single hub on one chain and many vaults.